Peak season is in grasp, and the ‘cost of living crisis’ is bearing down on households hard. This uncertain future has made planning for this year’s shopping season challenging. Customer behaviour has been difficult to predict and the extent of this economic shift has been murky at best.

The UK is expected to be the hardest hit among European countries, with a 22% decline in consumer spending expected.

To help retailers deshroud this ambiguity and address this fall in spending, Metapack and Retail Economics surveyed 8,000 global customers and 800 retailers on how they expect the ‘cost of living crisis’ to affect peak season spending and what this means for holiday shopping.

Metapack’s Holiday Spending Trends Report is far reaching, covering consumer expectations from across the UK, Germany, France, Spain and Italy, as well as the US, Canada and Australia.

From actionable data on regional shopper behaviour to the ever-present importance of seamless delivery, we uncover what consumers want before committing to the ‘Buy’ button and what their important concerns are.

Peak season sales numbers will be different

The majority of households will spend less this peak season. Fact. Few in society are immune to the effects of rising prices and inflation and this is evident in government data as well as in our report’s findings.

Your business will have noticed this squeeze and the effects of the economic crisis are occuring within brick and mortar retail, across ecommerce and within omni-channel retailing.

According to research more than 70% of UK shoppers plan to cut back on non-essential purchases this peak season. That’s a stark figure.

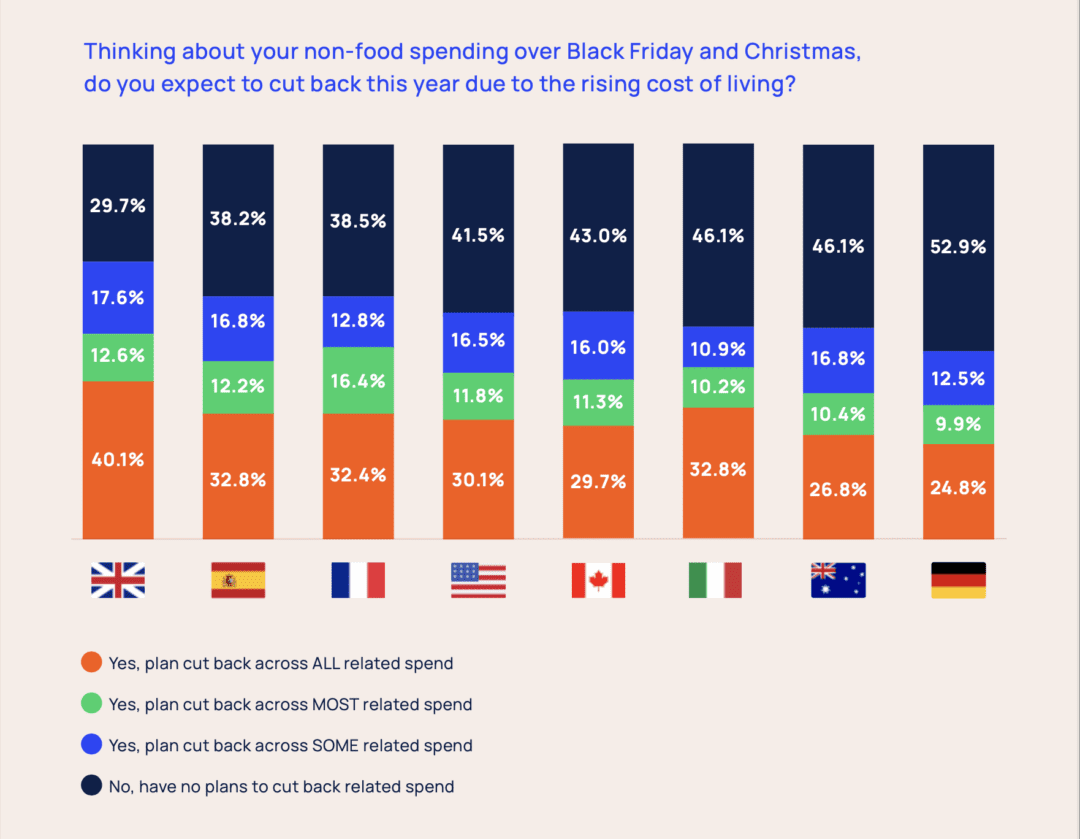

These financial pressures prompt behavioural change and this graph shows how consumers are responding.

With less disposable income and flagging retail sales, what can retailers do to cement customer loyalty and drive revenue? Let’s take a look at one major trend from our Holiday Spending Trends Report.

Delivery’s importance deepens

Flawless delivery, that’s what the data shows people want.

Firstly, 40% of customers surveyed indicated that the cost of delivery was their most important factor when they were deciding whether or not to purchase a product online.

Conversely, with more than 35% of retailers increasing delivery prices as a result of intense supply chain pressures, carrier price increases and other operational costs, customers are going to be in for a shock at the checkout.

Gaps have emerged between what consumers want, what they are used to and what delivery costs are absorbable on a retailer’s side.

Carefully crafted communication will be crucial to reducing the shock factor of price hikes and to prepare customers for any future delivery price changes. More are likely coming their way.

Rapid delivery wins

Also important is how quickly a package arrives. Customers still want same- or next-day delivery this peak season, especially those last-minute shoppers.

Over a quarter of customers consider these as the most important delivery options when choosing to buy online.

Again, we observe a disconnect between shopper and retailer. On the retailer side of the fence, many are extending delivery time frames to compensate for rising costs, import congestion and other unexpected holdups.

This coping mechanism yet again widens the gap between buyer expectations and reality, endangering conversion and sales volumes. Once again, tread carefully when communicating with customers.

Optimising the delivery process to increase sales

Once you have started to address this disconnect with your customers, turn to optimising your delivery practices because as our report shows, consumers clearly care about their delivery experience.

Here are four ways your business can optimise delivery:

1.Offer flexibility

According to our Delivery Benchmark Report, 50% of baskets are abandoned because of unsatisfactory delivery options.

Give options. ‘Click and collect’ should be a given as this offers convenience and flexibility while reducing last mile delivery costs.

2.Provide real-time delivery tracking

“Where’s my parcel?”, is a common question that takes up the valuable time of customer service representatives, but are you doing everything you can to keep customers updated?

Transparency throughout the order and delivery process is paramount. Once an order is placed, ensure your tracking informs shoppers where their order is at all times.

This visibility builds trust and gives customers the confidence to return to your business.

3.Prevent carrier congestion

Nothing is worse than Christmas parcels arriving after the big day. Relying on one carrier throughout peak season could lead to severe delivery disruption, especially with industrial action causing delays outside your control.

Implement a multi-carrier strategy that spreads the load across multiple carriers. In the event a carrier has disruption issues, your company won’t be affected and you can easily switch to another option to get your orders out the door and into the hands of customers.

4.Assess delivery costs

The pandemic ushered in the free delivery trend, but with rising costs this popular feature is looking increasingly difficult to maintain.

If you’re planning on removing free delivery, it’s important to set the scene by providing insight into why delivery and return costs are rising.

Once free returns have been removed, make sure this is communicated before customers reach checkout. This will prevent confusion amongst those who are familiar with your brand.

Purposeful data drives smooth delivery

We know peak is very close but there’s still time to review your delivery processes to ensure they tightly align with customer expectations.

Our delivery optimisation tips are meant as quick wins and are ideal for those selling cross-border.

There’s additional insight in our Holiday Shopping Trends Report that can unlock additional business growth this holiday season and our global research is a powerful ally when considering how to sell to international customers.

Whether your business is opening satellite distribution centres in Southern Europe, is enticing Australian buyers with difficult to obtain products or has taken America by storm in recent years, take advantage of the deep data available in our report for informed decision-making.