Over the past several years, consumers have been anything but predictable. As retailers grapple with yet another crisis that’s rewriting the rules of effective supply chains, online conversion and consumer loyalty, Metapack and Retail Economics have researched how the cost-of-living crisis is influencing customer behaviour, the potential long-term impact of the current cost-of-living crisis, and what product categories may be affected in the coming months.

Over the past several years, consumers have been anything but predictable. As retailers grapple with yet another crisis that’s rewriting the rules of effective supply chains, online conversion and consumer loyalty, Metapack and Retail Economics have researched how the cost-of-living crisis is influencing customer behaviour, the potential long-term impact of the current cost-of-living crisis, and what product categories may be affected in the coming months.

Our Holiday Shopping Trends Report called on the perspectives of more than 8,000 shoppers and 800 retailers from the UK, Spain, Italy, France, Germany, the US, Canada and Australia – a far-reaching global overview of the state of buyer behaviour ahead of peak retail season.

Historically consumer behaviour changes during times of economic crisis

Economic crises are nothing new. The early 1980s recession. The Dotcom crash. The 2008/2009 Global Financial Crisis. The consequences of COVID-19 pandemic.

Throughout these tumultuous periods, the move to ecommerce had been gradual with people increasingly gaining confidence with a new way of buying the products they love. The definition of a loyal customer has changed. Consumer expectations have intensified.

Most recently, the pandemic ushered in unprecedented changes in consumer behaviour. This pandemic-fuelled surge in online retailing was coined ‘the new normal’, but as restrictions eased, in-store shopping bounced back, omnichannel’s importance returned and margins have become tighter due to supply chain issues, rising materials costs and the scourge that is inflation.

The jury is still out on what the long-term effects of this current cost-of-living crisis will be but this ambiguity doesn’t necessarily mean retailers are left in the dark.

Economic turmoil influences consumer behaviour dramatically

To gauge what the future likely holds for retailers, let’s consider how people in 2022 are shopping in the face of this crisis.

Our extensive research report identified four types of cost-of-living crisis customer:

- Distressed – consumers most likely to cut back spending

- Secure but concerned – financially strong consumers presenting risk-averse attitudes towards spending in the face of rising inflation

- Stretched spenders – these shoppers like to spend but are on tight budgets – they will maintain a resilient attitude towards spending despite the rising costs

- Undeterred – these consumers have the greatest financial freedom and the economic crisis has a lesser impact on their shopping behaviour

58% of consumers expect to be affected by the global economic instability, with more than a third indicating that they’re already experiencing financial distress going into peak season. As the effects of the crisis start solidifying and if other global influences drag on, this percentage will continue to rise.

Pandemic induced economic drawbacks aside, if we reflect on the last global economic reset during 2008-2014 we see that consumers during that economic crisis mirror what we’re seeing with the current cost-of-living crisis.

What product category trends can we expect this year?

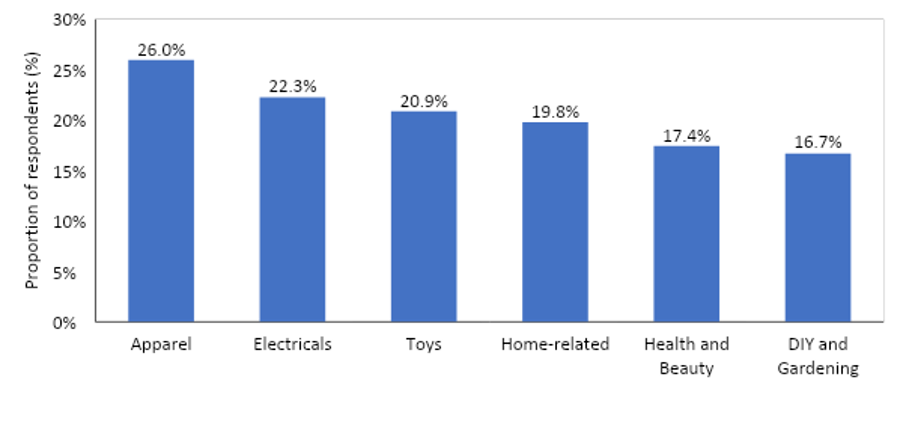

To help you plan for online demand throughout this unusual retail peak season, our report focused on six product categories:

- Apparel

- DIY and gardening

- Electronics

- Health and beauty

- Home-related goods

- Toys

One major difference between 2022’s economic crisis and past events is what households consider as ‘essential’ products. This definition is always changing, however some of the changes this time are striking.

Furthermore, the categories that are most at risk from decreases in consumer spending this peak season are also those that are facing broader changes to how consumers shop. There is a dual front of pressure bearing down on retailers in these product categories.

Apparel and footwear

Even before inflation started rising across the globe and the economic crisis took hold, consumers were already questioning fast fashion’s environmental credentials and reassessing whether rampant online ordering was sensible.

With numbers dipping because of evolving customer sentiment and sustainability concerns, the fashion and footwear industry stands to experience another knock this peak season as more than a quarter of consumers say they’ll be spending less on apparel and footwear.

That is a sizable percentage that will require serious levels of customer engagement to retain.

Electronics

Electronics retailers face two major threats. First, these products tend to be big ticket purchases and more than 20% of consumers said they would spend less on this category this peak season.

Additionally, retailers in this sector may see a further dip in online sales as customers say they’re more likely to purchase these products in-store. This is positive news for omnichannel retailers although purely online retailers need to consider what action is needed to counter this fall in sale.

How long do customers expect the 2022 economic crisis to last?

Like previous periods of economic instability, these gloomier days will pass one day, however for many, life will remain difficult for a considerable period.

Some commentators may position this period of uncertainty as another ‘new normal’, but consumer behaviour is fickle and can change quickly. Be agile and ready to adapt to defying circumstances, that’s how you should approach this challenge. There will always be pockets of improvement and some markets may recover faster than expected.

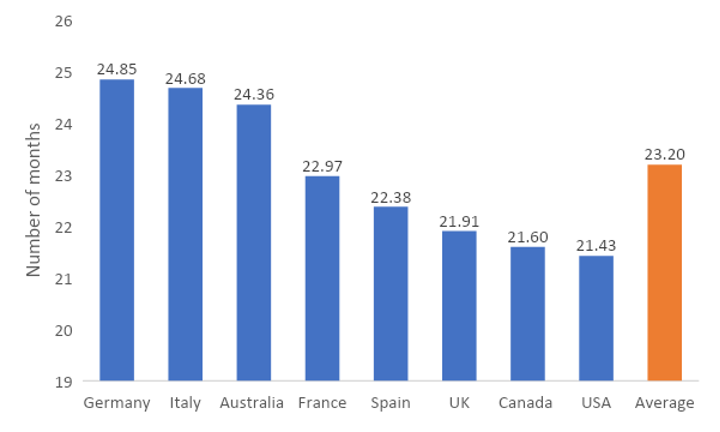

To understand how long consumers could curtail non-essential spending for, we asked people how long they expect rising inflation to affect their spending.

The data suggests that nearly a quarter of global consumers expect the 2022 economic crisis to impact their spending for the next two years.

While this will likely translate into lower sales volumes for the next 24 months, customer sentiment could brighten at any time if inflation is brought down to more manageable levels.

Retailers should prepare for unanticipated demand – and have the capacity and processes to meet customer expectations.

Understanding consumers through the 2022 economic crisis

Our Holiday Shopping Trends Report is the telescope needed to gain foresight and to sharpen your demand planning for this peak season and for beyond as the crisis likely bites down harder on consumers.

Using our analysis collected from shoppers across the globe, Metapack’s Holiday Shopping Trends Report provides you with actionable data to strategically plan for the future while simultaneously forecasting category demand for peak 2022.

Download the report for in-depth insight on global shopper sentiment and a host of other interesting trends primed to collide with this once-in-a-generation cost-of-living crisis.