UPDATE: August 21, 2025

Ahead of the August 29 de minimis exemption deadline, multiple international postal operators (Belgium, Germany, Japan, Singapore, New Zealand, Portugal) have announced they will no longer accept transit mail items bound for the United States starting August 20–22. Any misrouted/transit items sent anyway will be returned to origin. Additionally, U.S. Customs & Border Protection has issued guidance confirming all international mail shipments will be subject to duty payment. This means disruptions and costs may occur earlier than originally expected.

Things continue to evolve regarding duties and taxes on imported goods to The United States. The de minimis exemption for low-cost goods shipped from all countries (excluding Canada and Mexico) will end at the end of this month. Starting on August 29, 2025, shipments valued at or below $800 sent to the U.S. outside of the international postal network (i.e. USPS and its foreign postal partners) will be subject to duties and tariffs.

This shift in trade policy impacts both courier (i.e. UPS, FedEx, etc.) and postal (i.e. USPS and its foreign postal partners) low-value imports. Courier shipments will face full duties and tariffs and postal shipments will be assessed by either:

- Ad valorem duty: Percentage based on the country of origin tariff rate (IEEPA).

- Specific duty: Flat rate between $80 and $200 per item, depending on the country’s tariff.

Existing exemptions for personal travelers and small gifts remain in place. Visitors to the U.S. can still bring back up to $200 in personal items duty-free and personal gifts valued less than $100 remain duty-free.

What Does This Mean for Businesses and Consumers?

The elimination of the de minimis exemption will present ecommerce platforms, marketplaces, sellers, and small businesses with steep challenges with regard to cost and speed.

Those that ship low‑value, duty-free goods into the U.S. from other countries will likely see increased costs from new taxes and duties. If duties and taxes aren’t paid upfront (Delivered Duties Paid), customers may face unexpected charges at delivery. In these cases, many customers may refuse to accept packages with surprise fees, triggering costly returns. In some cases, returns may result in merchants paying duties and taxes twice, depending on the origin country.

Additionally, the added complexity and scrutiny on compliance may mean slower delivery times, as every parcel will be subject to customs duties and formal clearance procedures. This means more shipments, regardless of value, are likely to be held up by customs.

3PL providers are also under pressure to adapt and help customers navigate the shift by using formal entry processes and billing downstream. 3PL providers are under pressure to adjust their operations as the U.S. ends duty-free de minimis treatment. This means they must now file formal customs entries for more shipments, offer to pay the required duties and fees up front, and then invoice the merchants for those costs afterward (“billing downstream”), while also helping those merchants understand and manage the new process.

For consumers, this means potentially higher costs, slower delivery times, and overall frustration. Customers can expect higher prices and fewer product variety on items valued at or under $800 for overseas purchases, especially niche items previously imported duty-free. Not to mention, surprise fees at delivery does not result in a positive customer experience.

How Should Your Business React?

There are multiple ways companies can respond to the changes, from cost management to supply chain strategy. Businesses should re-evaluate their pricing and decide whether or not to absorb the duties and fees or pass them along to consumers. Here are some things to consider:

- Cost management: Re-evaluate pricing to absorb or pass on duties and fees.

- Supply chain strategy: Consider U.S.-based warehousing or sourcing to avoid customs costs.

- Compliance preparedness: Implement accurate country of origin and formal entry procedures.

- Logistics partnership: Collaborate with experts or customs brokerages.

- Legal monitoring: Track court developments and have contingency plans in place.

- Evaluate your checkout: Check if your platform can show shipping and estimated duties at purchase.

- Prepare customer service: Train your team to manage delays, questions, and disruptions.

- Stay informed: Follow reliable resources like the White House’s Presidential Actions and this blog post, which will be updated as new advancements are announced.

The pace at which global trade and cross-border policies change makes it increasingly important for sellers to stay resilient. This flexibility is especially critical when the shipping landscape changes so quickly and frequently as it does today. Fortunately, responding to new challenges doesn’t have to be that much of an added stress. With the right tools and software systems in place, you can get ahead of unexpected challenges or react to them appropriately.

From smarter ways to manage duties and taxes, to cross-border fulfillment and carrier flexibility, Metapack is continuously innovating to equip businesses with the tools and capabilities they need to thrive, no matter how the world changes:

- Metapack’s Consolidated Clearance helps you ship internationally without the complexity, the admin, or the risk with a flexible, automated system for allocating, labeling, and clearing international shipments—no matter the customs rule or destination.

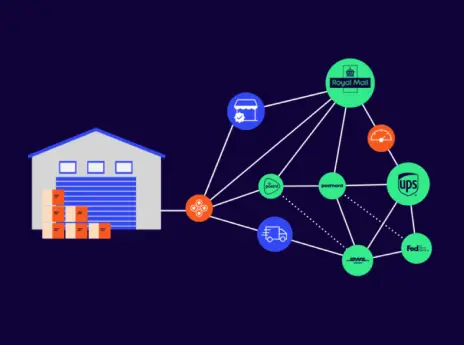

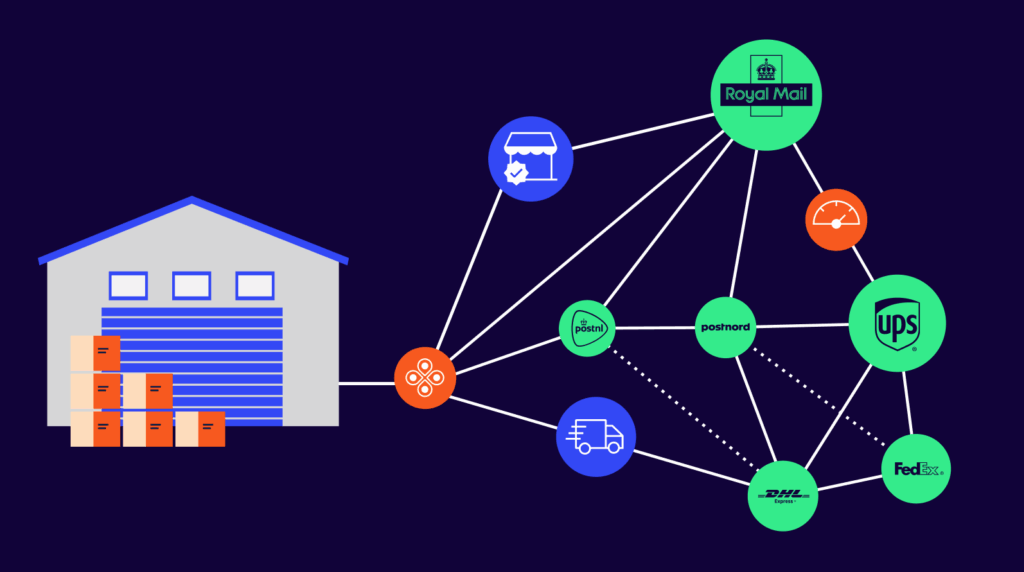

- Metapack’s multi-carrier shipping platform, extensive carrier library, and range of services enable you to diversify your options, reducing reliance on specific carriers or routes that are heavily impacted by tariffs.

- The capacity management functionality supports the dynamic distribution of volume, meaning it can be quickly switched between carriers during increased supply chain volatility to minimise any negative impact on operations.

- Customer service agents are empowered with normalised tracking data and exception events, enabling them to provide customers with clear and accurate updates for increased transparency and trust.

- Customs documentation such as CN22/CN23s and commercial invoices can be generated automatically to reduce the risk of delays.

- The Delivery Tracking API delivers end-to-end visibility for international shipments with multi-lingual support and precise timezone calculations, enabling proactive communication of potential delays, reducing queries, and improving customer trust.